civic tax relief cost

Ive been obsessed with personal finance for more than 15 years now. Since 2011 it has resolved the tax issues of over 10000 clients.

Tax Preparation Services Options Costs For Filing Taxes

Often a property tax is levied on real estate.

. Family Relief Plan 475 million in property tax rebates for families with a one -time property tax rebate payment to homeowners of 5 of. Kaegi botched COVID tax relief The Cook County assessor cut values based on jobs he thought neighborhoods would lose due to the pandemic. Provide basic needs without extra cost.

Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels. Donating land property or shares Tax relief when you donate to a charity. HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying education requirement imposed by the State of California to become a tax preparer.

About 1614000 citizens will get 100 per cent property tax relief. A vehicle leased by an active duty service member andor spouse is taxable. It is payable for relief efforts in a qualified disaster area described above.

The vehicle must be owned or leased by an individual and not used for. This can be a national government a federated state a county or geographical region or a municipalityMultiple jurisdictions may tax the same property. The taxpayer obtains contemporaneous written acknowledgement within the meaning of section 170f8 from the organization that such contribution was used for relief efforts.

CTEC 1040-QE-2355 2020 HRB Tax Group Inc. It was a wild miscalculation that worked out well for some. Although winning a new car may seem lucrative taxpayers often dont consider the potential tax consequences.

Tax Implications of Winning a Car. The Personal Property Tax Relief Act of 1998 provides tax relief for any passenger car motorcycle or pickup or panel truck having a registered gross weight of less than 7501 pounds. The taxpayer elected to have qualified disaster area tax relief apply to such contribution.

Tax relief on donations Gift Aid payroll giving leaving a gift in your will keeping tax records. Cost savings that occur when two or more products are produced jointly by a single firm rather being produced in separate firms. BMC the richest civic body in the country presented a budget of 4594921 crore for the year 2022-23 ahead of the civic elections.

Effective tax rate on profits This is calculated by taking the before-tax profit rate subtracting the after-tax profit rate and dividing the result by. A property tax or millage rate is an ad valorem tax on the value of a property. Exploring the world of money and the impact that money decisions have on our everyday lives has always been more than just a job for me.

The tax is levied by the governing authority of the jurisdiction in which the property is located. Optima Tax Relief uses a proprietary two-step tax relief process to assess and resolve tax cases. 500 accredited Optima Tax Relief as 1 fastest growing financial services company.

What is the Personal Property Tax Relief Act and does my vehicle qualify for Car Tax Relief. In the budget the civic body announced 100 per cent relief from payment of property tax for flats measuring up to 500 square feet of carpet area. But as a tax paying citizen it is imperative for the civic body to.

It must be resolved soon to give relief to citizens in these parts of the city. New cars generally cost tens of thousands of dollars. The Tax Foundation is the nations leading independent tax policy nonprofit.

It was formed in 1945 out of several organizations that had been existed through the 1930s and that had lobbied the state legislature to create the Plan E Charter option 1938 which featured a city manager form of. However it may qualify for a Personal Property Tax Relief Credit of 100 on the first 20000 of value pursuant to a contract requiring the service member andor spouse the lessee to pay the personal property tax and applies to a leased vehicle that would otherwise. The joy of winning a new car may quickly subside into anxiety and worry when tax forms start to arrive in the mail.

June 7 2009 - Once upon a time there was a civic organization in Cambridge known as the Cambridge Civic Association CCA.

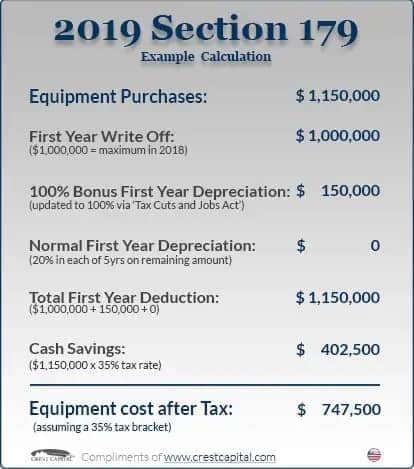

Section 179 Tax Deduction Downtown Ford Sales

Optima Tax Relief Reviews February 2022 Supermoney

Best Tax Relief Companies Of 2022 With Costs Reviews

Best Tax Relief Companies Of 2022 With Costs Reviews

Best Tax Relief Companies Of 2022 With Costs Reviews

Irs Tax Debt Relief Fast Affordable Professional Civic Tax Relief

Best Tax Relief Companies Of 2022 With Costs Reviews

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

/precision-tax-400169e3dbd446a1be799052091e9d6e.jpg)

The 7 Best Tax Relief Companies Of 2022

Optima Tax Relief Reviews February 2022 Supermoney

:max_bytes(150000):strip_icc()/Tax_Defense-2d3e786b6be44749beb3631441112aeb.jpg)

The 7 Best Tax Relief Companies Of 2022

:max_bytes(150000):strip_icc()/precision-tax-400169e3dbd446a1be799052091e9d6e.jpg)

The 7 Best Tax Relief Companies Of 2022

Best Tax Relief Companies Of 2022 With Costs Reviews

:max_bytes(150000):strip_icc()/alg-tax-solutions-295facd1924245c28b9a8c83356d1db4.png)

The 7 Best Tax Relief Companies Of 2022

Irs Tax Debt Relief Fast Affordable Professional Civic Tax Relief

Best Tax Relief Companies Of 2022 With Costs Reviews

Best Tax Relief Companies Of 2022 With Costs Reviews

:max_bytes(150000):strip_icc()/Community-Tax-023dc7021f0e4c57b62f26f8e91847dc.jpg)

The 7 Best Tax Relief Companies Of 2022

I Owe The Irs Back Taxes How Much Does Tax Relief Cost And What Are My Options Wiztax